The Remote Practitioner

Turnkey news

R3 Recovery Newsletter Feature – May 2020

Darren White and Deborah Baxter offer solutions for IPs currently working under lockdown.

Turnkey is delighted to feature in this month’s R3 Recovery News.

At Turnkey we have been helping our clients manage the significant shift from office-based working to home working. For some, this has been an easy transition, for others, more challenging.

Moving to paperless is a key component of the remote IP. Adopting paperless processes underpins this move, understanding how to utilise technology to introduce workflow for approvals, and automate where possible.

The article below details the key components an IP has to have in place to be fully remote and maps the path to future-proofing and preparing for the next step…

The Remote Practitioner

In the current climate, IPs and their teams have become wholly reliant on technology to drive remote working practices. Access to printers, post, paper, people and physical hardware is limited. The concept of the digital IP, documented in the February edition is now accelerating at an unexpected pace. What should IPs be focused on now to make life easier in lockdown and, more importantly, how can they prepare for the uncertainty ahead? Leveraging the best current and compliant technology solution is critical in keeping the wheels in motion. Taking steps to automate and fully adopt a remote, paperless, streamlined operation needs to start now.

The virtual, compliant office

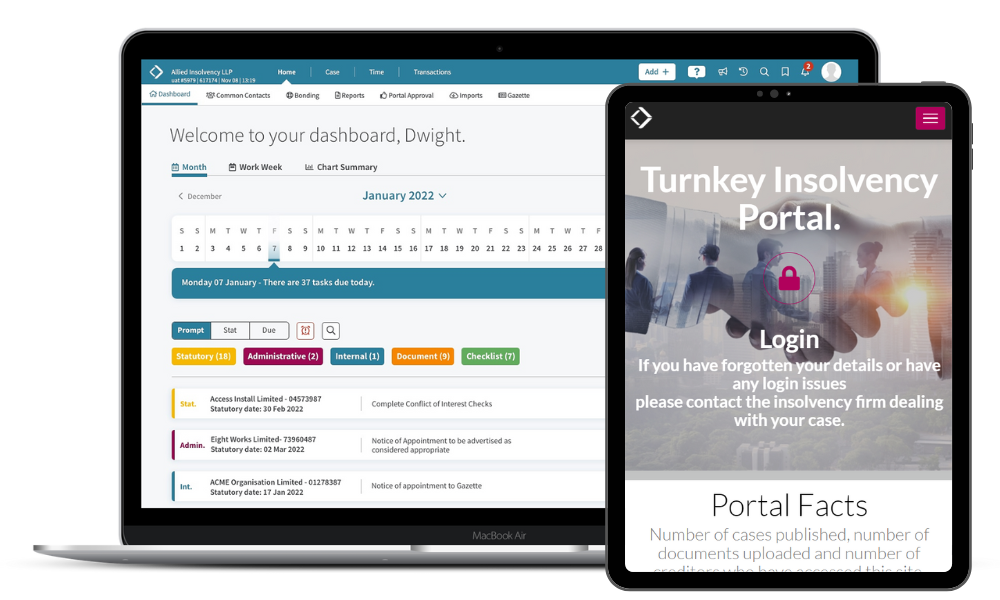

The basic key components of an efficient, digital insolvency office are a case management tool, a document storage/management system and a collaboration tool such as Zoom or Microsoft Teams.

Since lockdown, we have seen unprecedented changes in legislation to support the remote IP. In terms of case management, Turnkey has kept its Insolvency Practitioner System (IPS) entirely in sync with continuous updates. These include EAS CAU forms, VAT forms, changes to ERA limits, and the ability to store IPs’ signatures securely for use within Companies House and AiB electronic forms.

HMRC’s 9 April announcement notified IPs that receipt of dividend payments should now be electronic. This is another change requiring quick deployment, which IPS caters for through banking routines already in place with all the major clearing banks. This means you do not have to manually post each payment to HMRC separately through your e-banking platform, as IPS can create, send, and record the payment file for you. Automating manual processing is critical now, particularly if workloads rise and increasing staff headcount becomes challenging.

IPs must quickly adopt continuous change to their case management software to realise the benefits of the constant updates currently filtering through from regulators and key stakeholders.

Not being able to send physical post is a challenge for all IPs. Turnkey have partnered with an electronic post service, Postworks to print, envelope and post – all for less than the cost of a stamp. Utilising experts who have developed affordable technology is essential in reducing unnecessary risk to staff as well as driving operational efficiency.

The virtual, secure platform

A consideration for remote working is how to maintain and care for key systems while allowing secure, reliable, robust remote access and scale as your business needs it. The answer is ‘the cloud’. Cloud computing is the delivery of computing services – including servers, storage, databases, networking, software, analytics and intelligence – over the internet (the cloud).

Handing over the entirety of your infrastructure to a hosting provider is a big step, but one many other industries have engaged in successfully. Placing the support, maintenance and upgrade process in the hands of a reputable specialist supplier will give you the comfort that your teams will have full round-the-clock access to systems with minimal downtime or outages. In addition, the security and backup of your data will be managed effectively and in line with industry governance.

Turnkey is evolving its current IPS case management tool to a fully cloud hosted ‘Software as a Service’ platform. This means the delivery of the software will be centrally managed and continuously updated based on business process change and functional improvements. This ‘on-demand’ software model will give IPs the flexibility to customise business processes, integrate with in-house software and benefit from the ongoing investment to drive automation and digitisation into their own practices.

The virtual, managed meeting

The virtual, collaborative online method of sharing documents with key stakeholders forming part of an insolvency process has been around for several years.

To put into context, since January 2018, IPs have recorded £28bn of creditor claims using IPS, which includes £70m in the last 18 days of lockdown. Twelve billion has been lodged directly by creditors using the paperless creditor portal. Uptake is dramatically increasing given no one wants to receive or send post. The cost of processing a creditor claim manually via traditional printing methods, dealing with multiple telephone queries, adjudicating and distributing is estimated at c £30 per claim. IP firms that are now wholly delivering this service via the creditor portal are saving thousands of pounds by simply pushing the administration process online. Simplifying the stakeholder communication process and driving engagement has major benefits for both IP and creditors

In summary, here are five key steps you may want to consider in transforming your fully digital remote working office:

- Set up a taskforce or nominate a staff member who is interested and can drive the digital agenda of your business. Start small and identify quick wins.

- Evaluate any processes that require significant manual human interaction. Consider how best to achieve automation either through use of a case management tool or by adopting simple electronic workflow.

- Consider simplifying your technology infrastructure by investigating cloud hosting.

- Evaluate electronic banking practices with your case management supplier and bank.

- Get rid of unwanted paper! Use this as the opportunity to go paperless.

Accelerating the digital journey is now moving at pace across every industry. For the Insolvency Practitioner, this will significantly change when IPS moves to a Cloud-based SaaS platform, due for launch at the end of the summer.

This is a game-changer for many practices who want to be wholly Cloud (i.e. have no on-premise infrastructure to manage themselves).

Meet the Author

Deborah Baxter, Commercial Director, Turnkey IPS Cloud

Deborah brings over 20 years’ experience in driving technology and strategic change and is passionate about supporting clients with their digital strategy. Deborah joined Turnkey from KPMG where she was most recently focused on driving a digital transformation agenda across all aspects of their Restructuring practice.

Meet the Author

Darren White, Operations Director, Turnkey IPS Cloud

Darren has been driving the key product development within Turnkey IPS for over 30 years. Darren is responsible for managing operations and drives a team of dedicated professionals with vast insolvency, business and IT skills ensuring our client base receive both the product and support they expect.

Got a Question?

Just drop the team a message and we’ll get back to you as soon as we can.